Three key issues face the UK PR industry as industry bosses rush to mitigate issues caused by COVID-19, also known as Coronavirus.

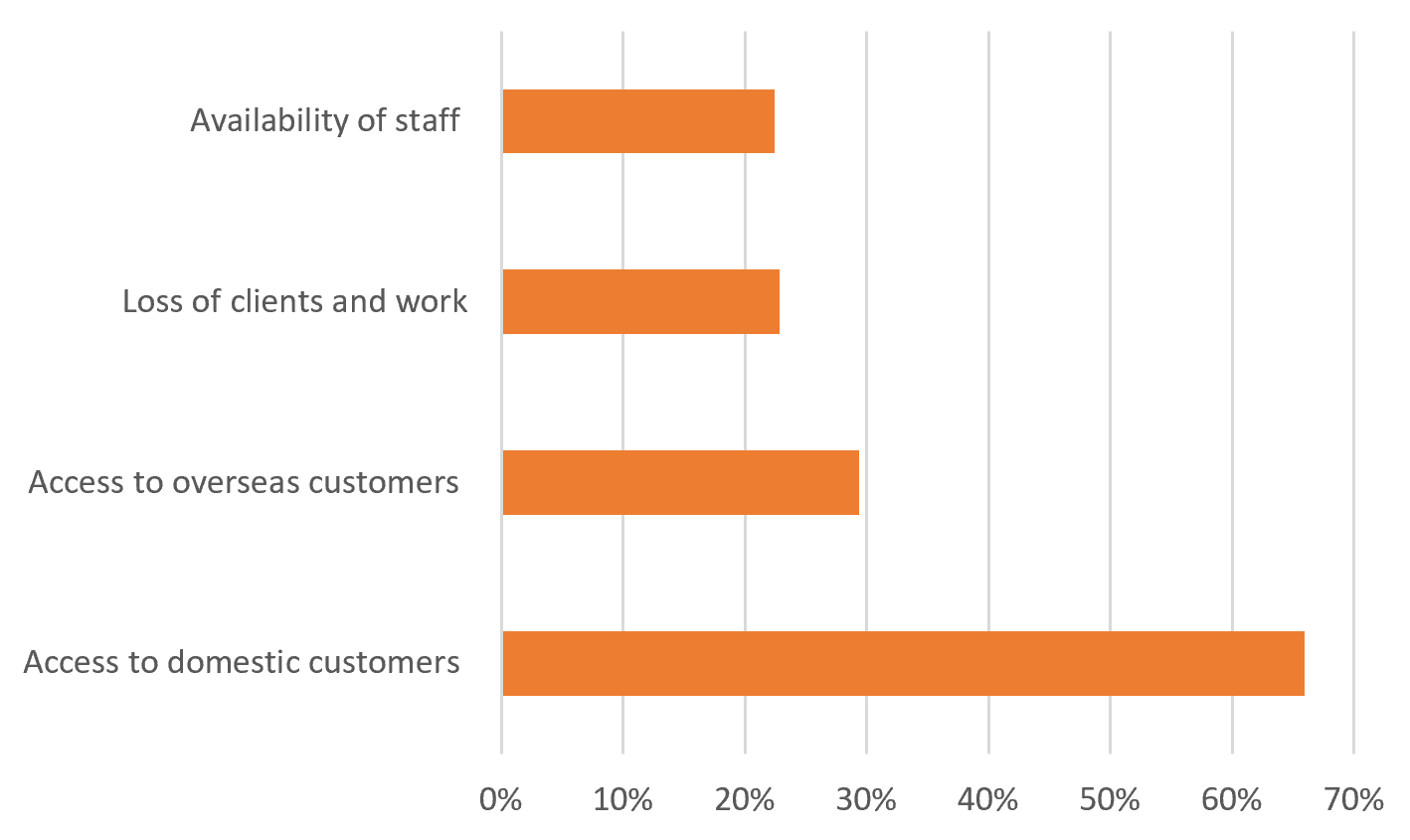

A survey by #FuturePRoof has found that access to domestic customers (57.4%) and loss of income (80.9%) are the biggest immediate challenges and longer-term, more than a third of respondents (31.3%) are worried about cessation of trading.

The complete #FuturePRoof COVID-19 report is published below this media announcement.

According to the PRCA PR Census 2019 the UK PR industry is worth £14.9 billion and employs 95,000 people.

Following the introduction of emergency financial measures by the Chancellor of the Exchequer it is also clear that one group still needing urgent support remains freelancers and sole traders.

One freelancer commented: “Why are self employed/sole traders being discriminated against compared to PAYE employees? We have no sick pay, paid holidays or any other perks and are means tested if we sign up for Universal Credit.”

Contingency measures being put in place by PR practitioners include new flexible working methods and patterns and prospecting for new business.

Areas of resilience include public health information and healthcare communication; crisis communications support; IT security and communication; education and learning; home entertainment and gaming; and home delivery. There has been a jump in government and public sector work.

Respondents recognised that the Government is dealing with a fast moving crisis and communicating a tough, unprecedented message as best as it can.

All results are being shared with the trade association PRCA and membership body the CIPR as they look to provide key interventions to aid business resilience and sustainability. Together they account for 40,000 practitioners in the UK. The data has also been shared with HM Government as part of industry lobbying efforts.

Sarah Waddington, #FuturePRoof founder and Astute.Work agency owner, said: “The results of this survey make for anxious reading. The negative impact of COVID-19 has been immediate and PR leaders are responding as fast as they can but need clarity over what help is available and how long this may last. On the plus side, a decent number of practitioners are generating new business. The hugely surprising omission is that internal communication doesn’t appear to feature as a service in demand, which is disappointing.”

#FuturePRoof chair and Metia managing director Stephen Waddington added: “With the industry shifting to virtual and flexible working in the space of a week it’s not surprising that respondents are reporting that immediate impacts of the crisis include isolation and juggling multiple demands including childcare, uncertainty and unemployment. It is critical that immediate support relates to mental health and wellbeing to reduce workforce anxiety and stress.”

Francis Ingham, Director-General of the PRCA, said: “These #FuturePRoof findings are stark: our industry is under sustained and unparalleled pressure because of the COVID-19 pandemic. We all need to be agile and imaginative in our response to this new environment - and the findings show that senior practitioners are moving quickly in exactly that manner.

“The findings also show appropriate appreciation of the Government’s successful and vital work in communicating its key messages in exceptionally challenging times. And I wish to endorse that sentiment by offering the PRCA’s and LGComms’ heartfelt thanks to the public sector professionals doing the hardest and most important work of their lives.”

Alastair McCapra, chief executive of the CIPR, commented: “The past few weeks have placed our professional community under tremendous strain, but they have also shown how creative, flexible professionals can respond with energy and compassion. This survey gives us a critical snapshot of how our colleagues are faring, and the case for support we will be making to Government tomorrow will be supported by the perspective it brings. Thank you to the #Futureproof community for this valuable insight.”

Other notable comments within the survey responses relate to uncertainty over the length of time COVID-19 will impact; a current lack of longer-term planning; and the impact that disinformation has had on public behaviour.

Survey methodology

These survey results reflect 115 responses to the survey in the 24 hours following its launch on Saturday 21 March 2020. Responses have deliberately been kept anonymous to allow PR leaders to freely share their situation.

The survey remains open and the response rate continues to rise. You can complete the five minute survey here.

ENDS

#FUTUREPROOF COVID-19 SURVEY

An analysis of the impact of COVID-19 on the UK public relations industry

1. Introduction

#FuturePRoof has asked PR industry leaders to characterise how COVID-19 is impacting their organisations.

The survey results are being shared with the CIPR and PRCA to help provide interventions that will support business resilience and sustainability. The data will also be shared with HM Government as part of industry lobbying efforts.

The initial results covered in this report are based on 115 responses to an online survey on 21 and 22 March. The survey remains open and further updates will be provided by the #FuturePRoof team throughout the crisis.

According to the PRCA PR Census 2019 the UK PR industry is worth £14.9 billion and employs 95,000 people.

2. Executive summary

Three key issues face the UK PR industry as industry bosses rush to mitigate issues caused by COVID-19.

Access to domestic customers (57.4%) and loss of income (80.9%) are the biggest immediate challenges and longer-term, more than a third of respondents (31.3%) are worried about cessation of trading.

Following the introduction of emergency financial measures by the Chancellor of the Exchequer it is also clear that one group still needing urgent support remains freelancers and sole traders.

Contingency measures being put in place by PR practitioners include new flexible working methods and patterns and prospecting for new business.

Areas of resilience include public health information and healthcare communication; crisis communications support; IT security and communication; education and learning; home entertainment and gaming; and home delivery. There has been a jump in government and public sector work.

Respondents recognised that the Government is dealing with a fast moving crisis and communicating a tough, unprecedented message as best as it can.

Other notable comments within the survey responses relate to uncertainty over the length of time COVID-19 will impact; a current lack of longer-term planning; and the impact that disinformation has had on public behaviour.

3. Immediate impact of COVID-19

The ways in which COVID-19 is impacting the public relations industry are:

4. Medium term impact of COVID-19

The following issues were cited as concerns for the public relations industry over a two to three month horizon:

5. Contingency measures

Public relations practitioners are focusing on the following short term contingency measures to address the crisis:

6. Areas of resilience throughout COVID-19

As a professional service industry the public relations industry has been impacted by COVID-19. However, practitioners are responding to the crisis by providing organisations with services in the following areas:

Public health information and healthcare communication

Crisis communications support

IT security and communication

Education and learning

Home entertainment and gaming

Home delivery

Government and public sector

7. The Government response

Almost half (48.7%) found the government response useful or somewhat useful. 11.3% found it neither useful nor not useful. 40.0% found it not so useful or not useful at all.

Income protection for freelancers and sole traders is the biggest issue that the Government must address. These roles have been the first to be cut where budgets have been impacted. Measures for salaried employees were introduced by the Chancellor of the Exchequer on 20 March.

The increased frequency of press conferences and use of experts has been welcomed. There was a broad call for greater clarity in Government communications. Several respondents criticised a slow and vague approach.

The financial incentives introduced by the Chancellor aimed at keeping the economy moving have been welcomed but respondents called for detail quickly so that they could plan.

Respondents recognised that the Government is dealing with a fast moving crisis. They recognised that it is communicating a tough unprecedented message as best it can.

8. Impact on personal wellbeing

The immediate impact of the crisis following a wholesale move to virtual working and school closures include: isolation and juggling multiple demands including childcare, uncertainty and unemployment. These have led to respondents reporting mental health and wellbeing issues including anxiety and stress.

Organisational leaders said that keeping morale high was their key challenge. Helping staff to build mental resolution was also cited as a challenge.

9. Other issues

Other issues cited by respondents to the survey that haven’t been included elsewhere are:

Information about how long the crisis is expected to last

The impact of disinformation communicated via the media and social media on communication and mental wellbeing

Organisations are dealing with the immediate crisis. Longer term planning needs to happen.

Availability of practitioners to support national and local government campaigns, and the NHS

Planning for the future and the upturn. What will the industry look like after the crisis?

10. Methodology

115 people responded to an online survey on 21 and 22 March. The survey remains open and further updates will be provided by the #FuturePRoof team throughout the crisis.

11. Profile of respondents

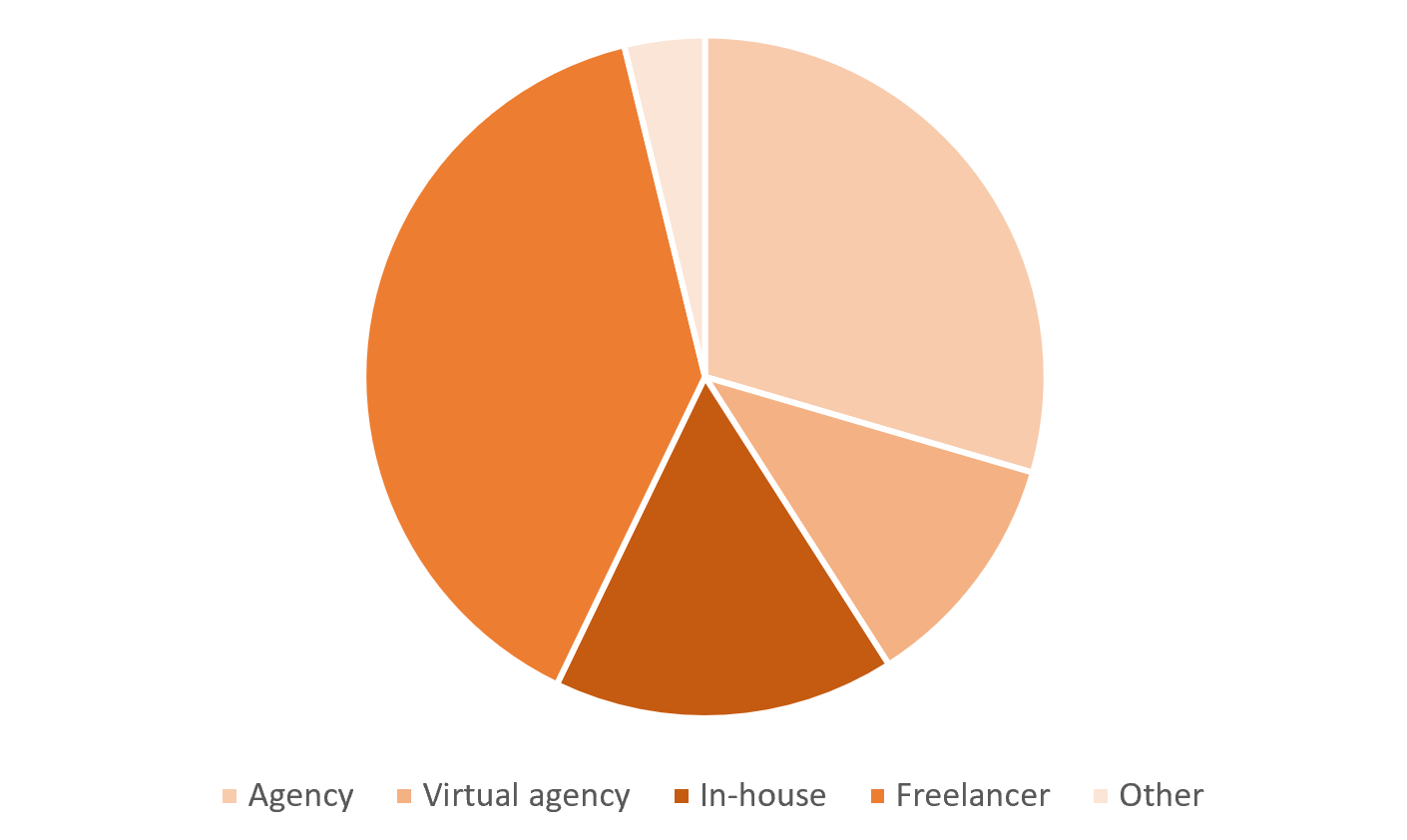

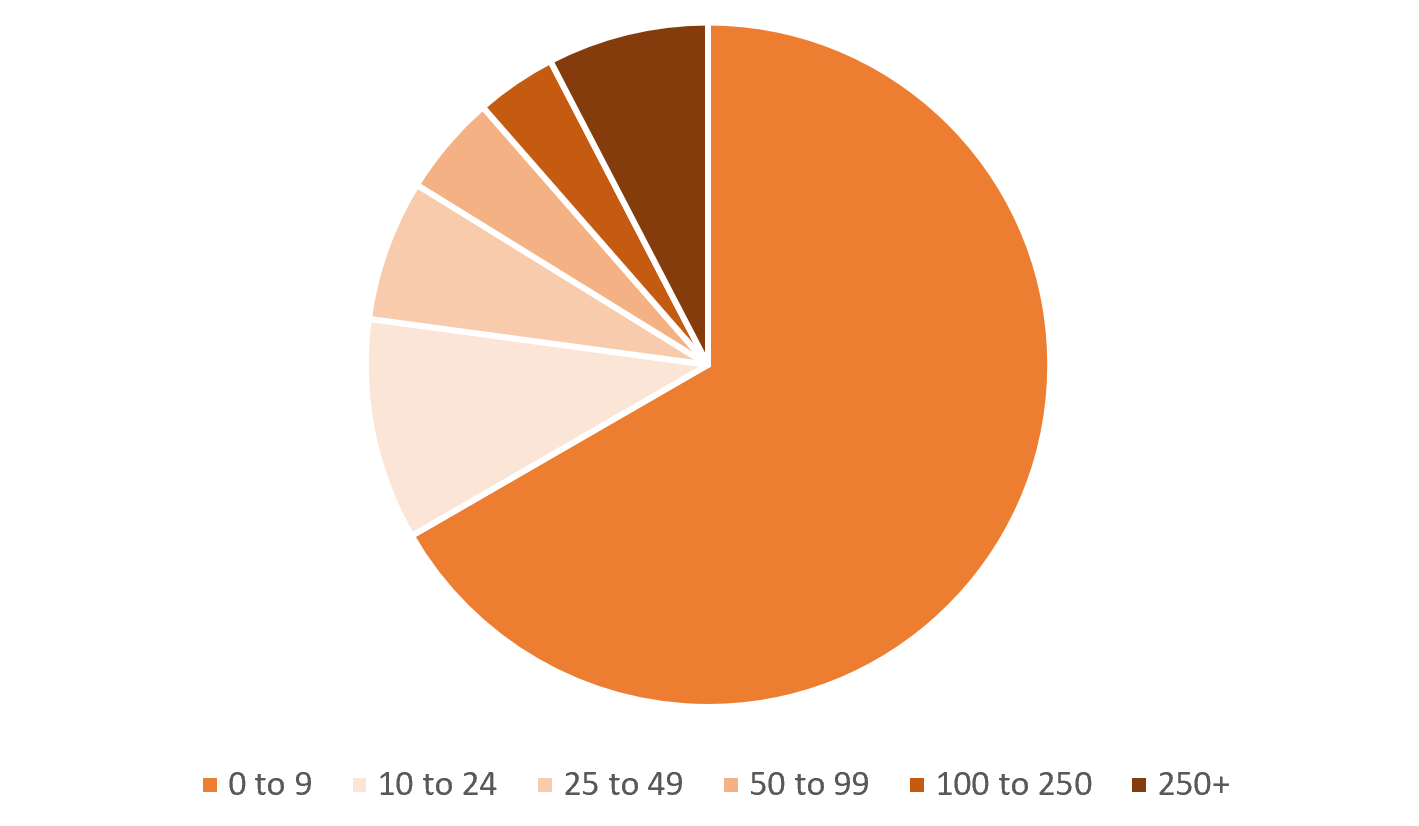

The profile of respondents is broken out below.

11.1 Type of organisation

11.2 Size of organisation

11.3 Market sectors

Respondents cover a broad range of sectors. These include but are not limited to:

Charity

Business-to-business: aerospace, construction, professional services, and technology

Business-to-consumer: arts, beauty, drink, entertainment, food, leisure, and toys

Public sector: education, health, and local government

12. About #FuturePRoof

#FuturePRoof was launched in November 2015 to remind public relations practitioners and the wider business community of the value of PR and assert its role as a strategic management discipline.

All costs associated with the design, production and marketing of #FuturePRoof are paid for by Astute.Work as part of managing director Sarah Waddington’s mission to improve social mobility within the PR industry by making thought leadership and best practice accessible to all.

For more information visit www.futureproofingcomms.co.uk, join the #FuturePRoof Facebook group and follow @weareproofed.